The Ultimate Guide to Maximizing Small Spaces with Fitted Furniture

Don’t let limited space hold you back from creating the home of your dreams

Can you see through semi-sheer curtains at night?

Semi-transparent drapes provide a blend of aesthetic appeal and practicality, catering to individuals seeking a balance between beauty and seclusion. These curtains allow gentle light […]

The Evolution of London Plumbing: A Brief Guide

Say goodbye to costly repairs and frequent maintenance issues with our innovative approach to plumbing services

Finding the Right Lawyer

Don’t delay – let us help you find the right lawyer today! Contact us now 02031377866

TOP TRENDS IN ROOFING FOR THE MODERN HOME

Don’t miss out on the opportunity to enhance your home with the top trends in roofing for the modern homeowner.

Bitcoin approaches an 18-month peak as ETF speculation increases.

The bullish momentum’s influence is not confined to the wider cryptocurrency market; it has also extended its reach to related stocks. Bitcoin’s value skyrocketed to […]

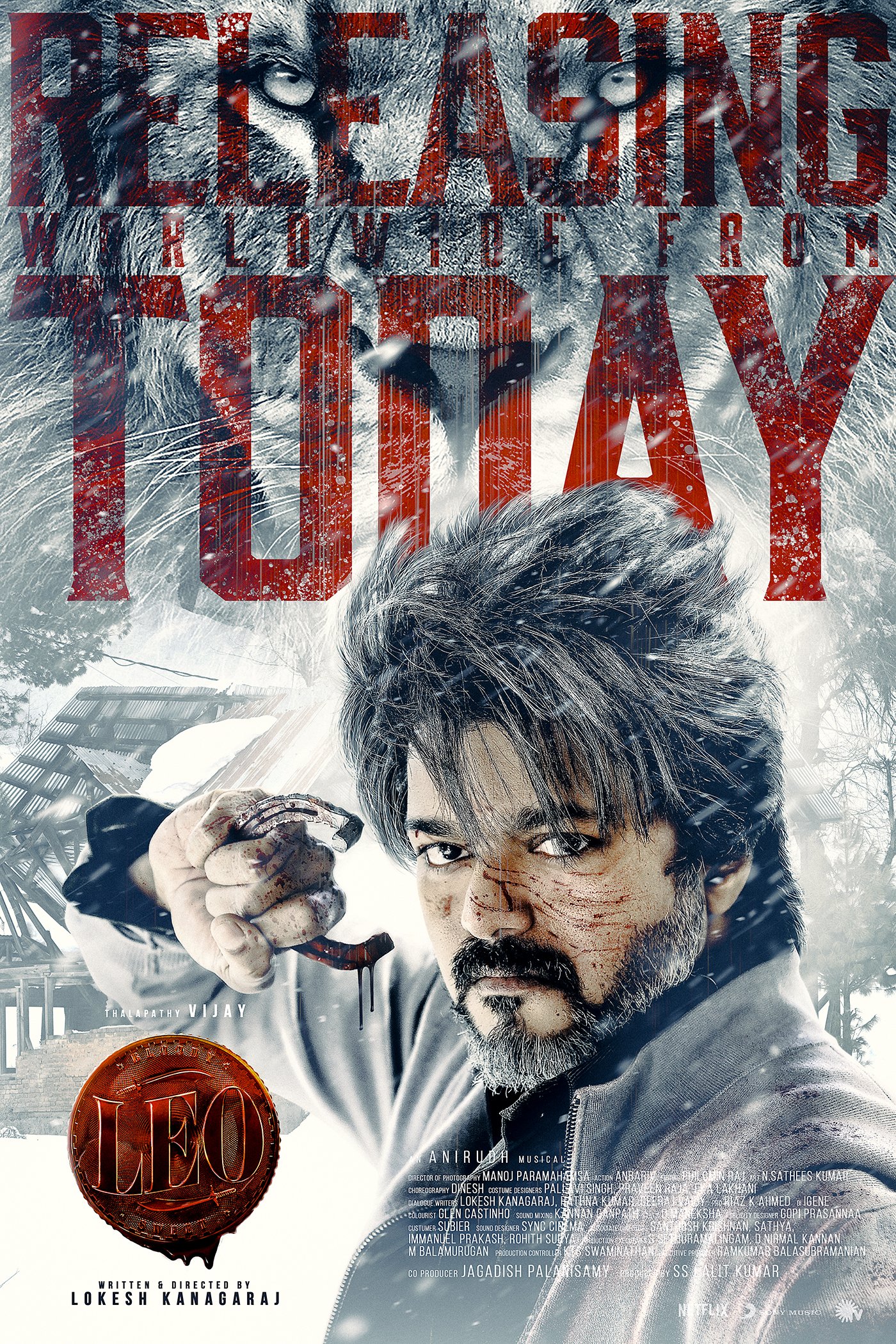

Leo: Bloody sweet Globally Collection

Leo: Bloody Sweet, the latest film by Thalapathy Vijay, has had a tremendous start, with predictions of earning approximately Rs 145 crore worldwide on its […]

‘Leo’ Netizens are split on Thalapathy Vijay’s thrilling action film, with contrasting first impressions.

‘Leo’ audience reactions: Thalapathy Vijay fans and moviegoers on X, formerly known as Twitter, had differing opinions on the film’s opening as it received mixed reviews. […]

Can we expect to see Messi on the field tonight for Inter Miami’s game against Charlotte?

Inter Miami has only two matches remaining on their schedule, both against Charlotte. The first game will take place at home, while the second will […]